About Us

Fair Mortgages: the right choice

The essence of the Fair Mortgages service is professional independent mortgage and protection advice brought to you by a team of specialist advisers and experienced administration support.

Our services include:

We know that all that is involved can be daunting, but no matter how complicated the mortgage process might first appear, we will explain it all to you in plain terms, and provide you with all of the support that you need.

Or you may be more experienced, perhaps looking for the best remortgage, raising capital to pay a deposit for your child’s first mortgage or you have an extensive Buy To Let portfolio.

The mortgage market is ever changing, and having an expert on hand to give you information and guidance remains vital for you to reach an informed decision.

Whatever your experience, by using our service and speaking to our specialist mortgage advisers, you have made the right choice.

A big decision, get it right

Your mortgage is probably the largest financial transaction that you will ever undertake, and you should feel 100% comfortable with your decision at every stage of the process. Getting professional, affordable and reliable help to make the right choice can help to ensure this, so don’t try to navigate the mortgage jungle on your own!

We know there is a vast amount of choice available to you, and that the search for the right mortgage can be very confusing. Our goal is to help you to make the right decision, as getting stuck with a mortgage that is not a good fit for you can have serious financial repercussions that you be tied to for a number of years.

Do you research of course, but always make sure you speak to us as well...

Challenges in the mortgage market

Recent changes to mortgage regulations have had a significant impact on how people can find and apply for the right mortgage; you may have already seen coverage of this in the press.

The one change that has had the greatest impact is the need to ensure that when selecting your mortgage lender, your circumstances meet their criteria and that you provide all of the necessary information about your circumstances right at the start; otherwise, your application might be delayed, or even rejected out of hand. This means that getting good advice from the outset is more important than ever before, not just to make sure that you make it through the first stage, but every stage thereafter to ensure you have a smooth path to completion.

5 reasons to use Fair Mortgages

1. Specialist and independent advice

We provide a personal and professional independent advice service which does not stop simply because your mortgage application has been completed. Understanding everything that you should consider in the advice process is critical, and our mortgage and protection specialists bring years of knowledge and experience to help. All our advisers are fully qualified and regulated by the FCA.

2. Access to over 5,000 mortgages from over 72 lenders

As an independent mortgage adviser, we have access to over 5,000 mortgage deals from over 72 UK lenders, including exclusive mortgage deals. Our systems utilise the latest research software to help you get the best deal for your circumstances.

3. Access to additional services, carefully selected by us

Including valuations, conveyancing, general insurance and more, we can take the hassle out of making sure you get access to quality and affordable products and services. The products are hand picked by ourselves, which means getting things done in a timely and efficient manner. Our advisers are professional and accountable, which inevitably means higher service standards.

4. Contacting you when and how you want

We all lead busy lives, so making sure you are contacted quickly and in a way that is easiest for you plays an important role. We offer a combination of telephone, email, post and texts, delivered according to your needs so that your mortgage is always the top priority. We ensure a smooth and successful outcome in all aspects of our mortgage service.

5. In safe hands, each step of the way

At Fair Mortgages we know how important each step of the mortgage process is. Knowing who to contact, what to ask and how to ask it can make all the difference in making sure we deliver a smooth and successful mortgage service, that you will want to come back to again and again. This is why you will not only speak to the same adviser throughout the mortgage process, but you will also have a dedicated line of support selected from our experienced administrator and adviser support team.

The all important first steps

By the time you are reading this, you have no doubt already started looking around with a view to making your final decision, by Googling mortgage information and asking people you trust about their own experiences. Now is the time to get in touch with us, to have a quick chat about your circumstances and what is important to you.

We offer a free, no strings attached, no pressure initial consultation, and will take some basic details from you before arranging a time for one of our advisers to get in touch. This can be the same day, during the evening, or at the weekend; whatever works best for you. We are confident that once you become familiar with our approach to working with you, and the knowledge and experience that our specialist mortgage and protection advisers can offer, you will be happy to retain Fair Mortgages to add value to your mortgage application process and beyond.

Complete our enquiry form to find out more »

Need to know how much you can borrow? Our approval in principle service

If you have not yet found a property or have just seen the property you want and need to know with greater certainty how much you can borrow so can put in an offer, our approval in principle service is the best option. Get ahead of the rest by securing an approval in principle with a specific lender. Vendors often look for this when deciding on whose offer they accept – it’s not always on price, it’s often who’s ready to move quickly.

We will also guide you through the initial stages of the house buying process and how to deal with estate agents – the dos and donts, what you really need to know and how to go about it.

Need to act quickly? Our Fast Track service

For those who have a deadline or who need enhanced service levels for whatever reason, our Fast Track service is the best option. Certainly trying to complete such a complicated transaction as a mortgage on your own, especially if timing is top priority, could prove costly. Whilst many lenders, banks and brokers are taking weeks simply for an initial mortgage appointment, you can speak to us immediately or if not we’ll call you back within 24 hours.

We deal with your initial enquiry quickly, and aim to turn around the mortgage advice and recommendation within agreed timescales tailored to you. You will have two key designated points of contact from start to finish – your mortgage adviser and your case handler.

We also have carefully selected conveyancers with national coverage and a chain of dedicated surveyors (independent of the lenders of course), all at competitive rates and working to market leading timescales. Our priority is you and your mortgage. You can track its progress and your details at anytime online.

Our mortgage recommendation, tailored to you

As an independent mortgage adviser, we have access to the UK mortgage lender market and over 5,000 different mortgage deals available, including many exclusive deals that are not available directly to the public. This means we can find the very best mortgage for you from all of those available.

The experience of our advisers in combination with them having access to the whole mortgage market means we can cut through the fine print and explain the pros and cons of each product out there. This makes life easier for you, and allows us to tailor our recommendation to the best mortgage for your circumstances.

Applying for your mortgage

Once we have found and agreed on the right mortgage for you, we will manage the application on your behalf, liaising with the lender to ensure that it is processed as quickly as possible. We will use our knowledge and experience in this area to ensure that the whole process happens in line with your expectations. We will of course keep you informed at every stage of the procedure, by phone, text and email; whatever works best for you. We will also provide you with access to our Life and Income protection service.

Once your mortgage has completed successfully, we will stay in touch with you to ensure that you are happy with the service that we provided to you. We will also agree a future time to contact you, to provide you with options going forwards when your existing mortgage deal comes to an end, in order to help you to keep your mortgage costs down and pay off your debt as soon as possible.

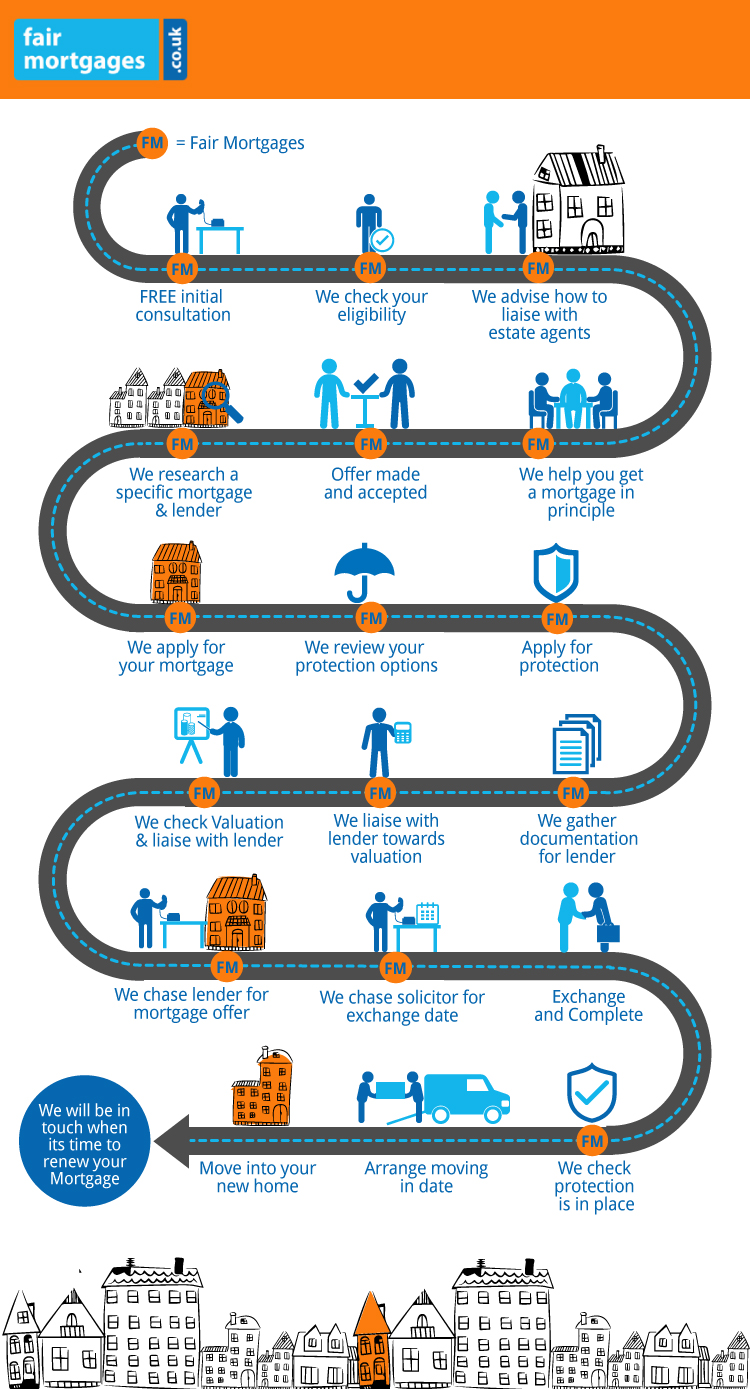

Our mortgage process can be illustrated as follows:

Complete our enquiry form to find out more »

Why not go direct to a lender or a fee-free broker?

You might be thinking ‘Surely the cheapest rates are online?’. It is entirely possible to look online for the lowest mortgage rate, find a fee-free mortgage adviser or attempt to negotiate directly with the lender, and we do encourage you to consider these options.

However, when it comes to getting sound advice and experienced guidance on which route you should commit to when buying your mortgage, you need to speak to Fair Mortgages to help and advise you and make sure that final decision is indeed the right one. Plus don’t forget, our service does not stop when you get started.

We continue to offer an ongoing support service to our customers, by offering regular reviews of your mortgage and protection requirements.

Remember, the lowest rate is not necessarily the right mortgage for you

Understandably, the seemingly-lowest percentage rate available to you might appear to be the most appealing, but this might not be the perfect fit for your property. For example it may not be available to you in the area where you live, or allowable for someone with your income and monthly spending habits.

It also might not offer you the option to remortgage in the timescales you require, or allow you to let the property out at a later date if you wish to buy another property and rent your current home some way down the line.

There are numerous factors to consider as part of your mortgage-buying decision, and the lowest rate or cheapest fee is just a couple of them. We will help you to understand the whole range of factors that make up the right mortgage choice for you, and provide you with all of the information and advice that you need to make an informed decision, and one that you will be happy with in the future as well as right now.

Fair Mortgages: a fresh and dynamic approach, built on experience

Fair Mortgages offers a fresh and dynamic approach to the mortgage advice process, developed around the current mortgage market and the changing needs of customers. The foundations of our service are built on the knowledge and experience of our mortgage and protection specialists, working closely with our experienced support team.

Fair Mortgages Limited is an appointed representative of Fair Investment Company Limited, who are authorised and regulated by the Financial Conduct Authority (FCA).

Fair Investment Company Limited was established in the year 2000, to provide a range of online financial services and products to the UK market.

Our clients include individuals, business, charities, trusts, pension schemes, and clubs and associations. We are specialists in gathering a full understanding of our customers’ needs, understanding the modern demands on delivering financial services and developing a first-class service around them.